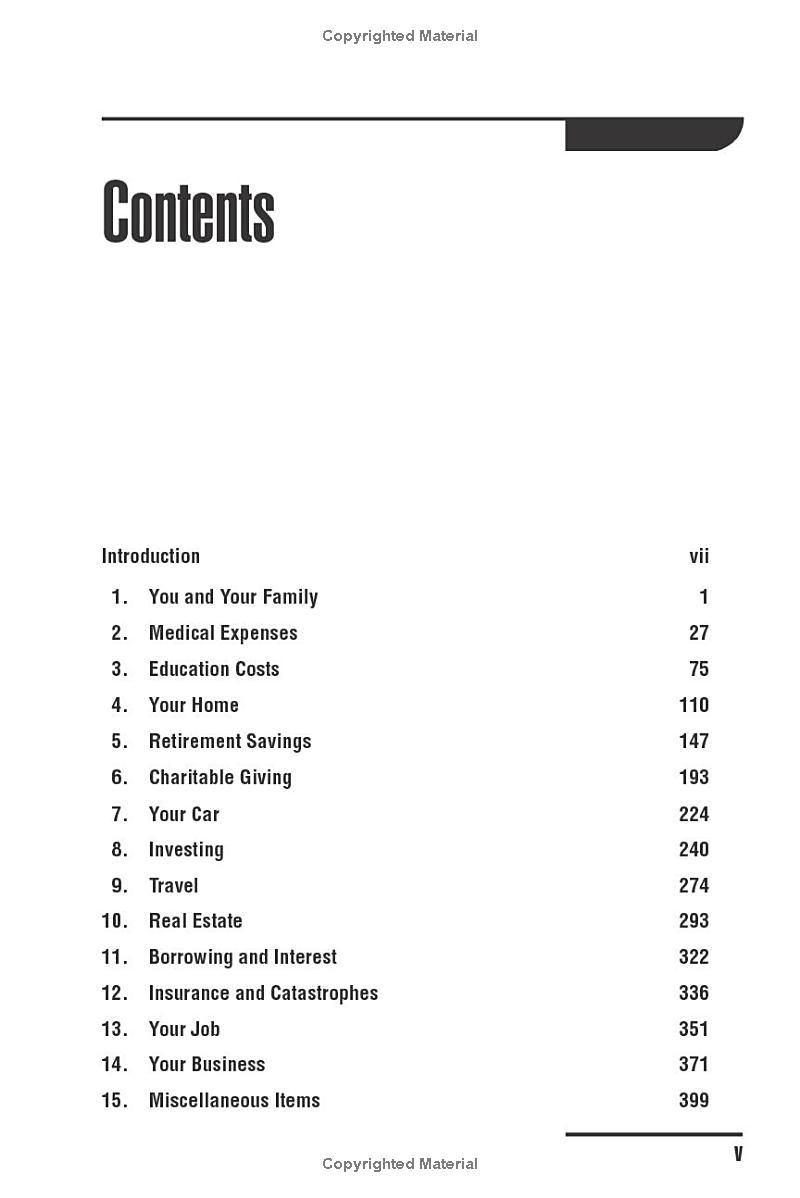

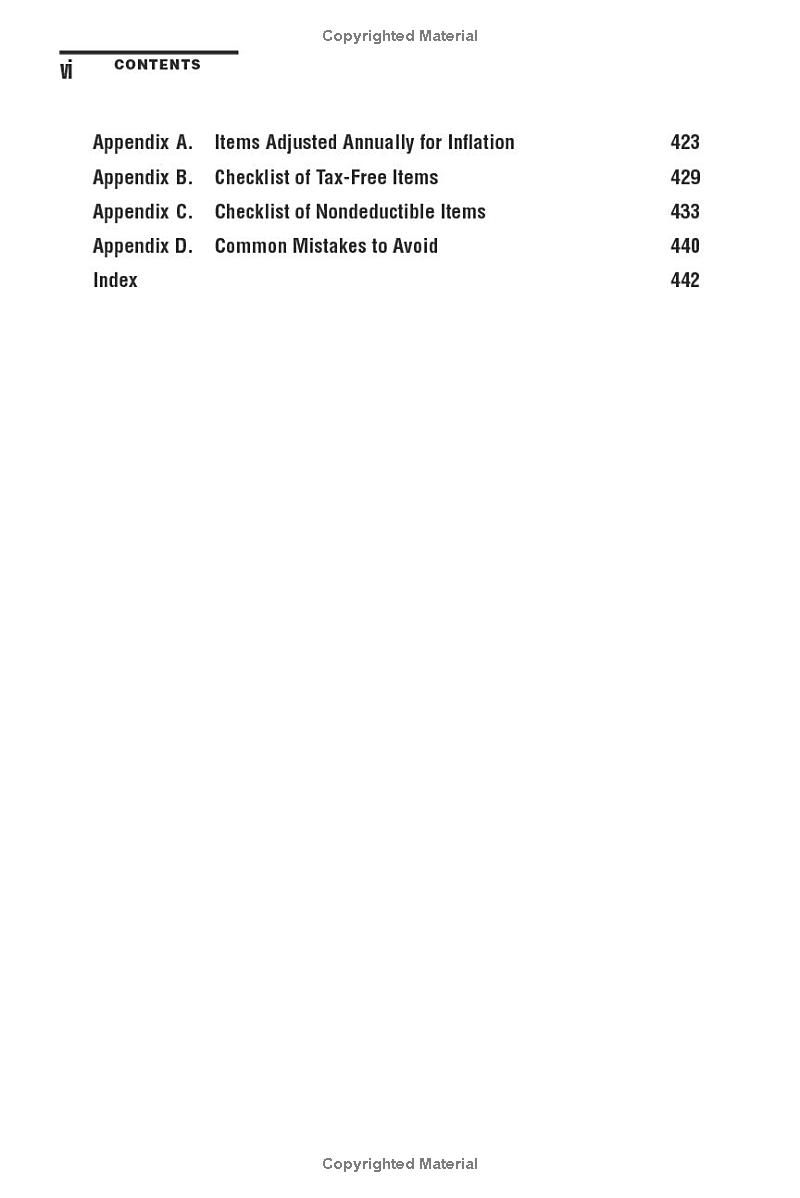

Facing tax season with dread? J.K. Lasser's 1001 Deductions & Tax Breaks 2025 offers a lifeline. Tax attorney Barbara Weltman, building on the trusted Lasser legacy, provides a comprehensive guide to maximizing your deductions and minimizing your tax burden for the 2024-25 tax year. This updated edition reveals hundreds of potential savings, covering individual and small business tax situations. With clear instructions, record-keeping tips, and the latest IRS rulings, you'll learn to navigate tax laws confidently. Discover previously overlooked deductions, understand dollar limits and filing requirements, and utilize the included e-supplement for the most up-to-date information. Stop overpaying – claim what's rightfully yours with this indispensable tax guide.

Review J.K. Lasser's 1001 Deductions & Tax Breaks 2025

Let me tell you, J.K. Lasser's 1001 Deductions & Tax Breaks 2025 is a lifesaver! I've always considered myself pretty savvy when it comes to taxes, but this book absolutely blew me away. I honestly thought I knew most of the deductions available, but Barbara Weltman's expertise unearthed a whole treasure trove of opportunities I'd completely missed. It's not just a list of deductions either; it's a comprehensive, incredibly detailed guide that walks you through everything step-by-step.

What I appreciated most was the clear and straightforward language. It avoids the confusing jargon that often plagues tax guides, making even complex topics easy to understand. Weltman presents the information in a logical, accessible manner, so you don't feel overwhelmed by the sheer volume of information. Each deduction is explained thoroughly, including the record-keeping requirements, dollar limits, and precise instructions on how to claim it on your return. This level of detail is invaluable, ensuring you're not leaving any money on the table due to incomplete or incorrect filings.

This book isn't just for the self-employed or small business owners; it's a fantastic resource for everyone. Whether you're a single filer, a married couple, or a family with children, there are likely numerous deductions applicable to your situation that you might not be aware of. The book expertly covers a vast range of scenarios, making it relevant and useful regardless of your specific circumstances. I found myself constantly thinking, "Wow, I can deduct that?" It's a real eye-opener.

The inclusion of the e-supplement is a brilliant touch. Tax laws are constantly changing, so having access to the latest updates and developments from the IRS and Congress ensures the book remains current and accurate. This is a crucial element, preventing you from relying on outdated information that could lead to errors or missed opportunities.

Honestly, the peace of mind this book provides is worth its weight in gold. Knowing you have a reliable, authoritative guide to navigate the complexities of tax season is incredibly reassuring. It empowers you to take control of your finances and ensure you're not overpaying your taxes – which, let's face it, is a fantastic feeling. The investment in this book pays for itself many times over in the tax savings it helps you uncover. If you're even slightly hesitant about purchasing it, just do it. You won't regret having this comprehensive and indispensable resource on hand, especially during tax season. It truly is the ultimate guide to maximizing your deductions and minimizing your tax burden. Highly, highly recommended.

Information

- Dimensions: 5.8 x 1.3 x 8.8 inches

- Language: English

- Print length: 464

- Publication date: 2024

- Publisher: Wiley

Preview Book